no income verification home equity loan

Get a short term loan when you work for yourself. A loan underwriter will review your financial profile The underwriter will compare it to the home equity loan requirements and guidelines for your chosen loan or line of credit.

No Income Verification Loans Nationwide Stratton Equities

Download this template as a.

. Typically there is more equity required on no doc loans. If you receive SUPPLEMENTAL or RETIREMENT INCOME. 30 60 and 90-day Mortgage Lates OK.

Current or most recent year For Home Equity Line of Credit applications. Personal loan denials vary but the most common reasons relate to your credit score credit history and income. 10K Home Equity Loan x Interest rate of 575 1530 in interest over 5 years.

The value of investments held by the Fund may increase or decrease in response to economic and financial events whether real expected or. Up to 15-year variable annual percentage rate APR loan up to 10-year and 20-year balloon fixed APR loans available. For Purchase transactions 12 months rental history verification is required.

Most recent 2 months of deposit history may be used in lieu of a Social Secuity Income Award Letter and most recent 2 consecutive. Self-employed loans get a personal loan to help get your bank account back in the black even with no proof of income. If approved you will receive a written commitment of terms and conditions.

No Income Verification Home Equity Loan HELOC and Refinance Credit Line Highlights. Learn your options to still get approved. Word document docx Google document.

Expiration Dates are based on the Note Date of the Loan. When you have good credit LightStream offers low-interest fixed-rate loans from 5000 to 100000 for practically any home improvement project you. 600 Credit Scores Hybrid Refinance ARMs Fixed Rate Equity Loans 15 20 and 30-year amortization Interest Only Mortgages Available.

The amount of equity you currently have in your home will determine the Home Equity Line of Credit HELOC limit or Home Equity Loan value Consult with a Home Equity expert to determine your estimated credit limit or loan value amount. O Credit Documents IncomeAssetCredit report 60 Days. Minimum 5000 loan amount.

O Collateral - 90 days o Title - 90 Days. If your home is valued at 150000 and you owe 100000 then your homes equity is 50000. Reimbursement fee of up to 250 if loan is reconveyed within 24 months.

Loans from 500 - 5000. The federal government created several programs or government sponsored entities to foster mortgage lending construction and encourage home ownershipThese programs include the Government National Mortgage Association known as Ginnie Mae the Federal National Mortgage Association. Mortgages have loan-to-value LTV ratios of 80 or less.

The verification of your financial. Employer and income verification Unsecured personal loans are different from many other types of loans like mortgages or auto loans. Consider the type of project youre doing your credit income and whether you have equity in your home when evaluating your options.

A home equity loan is a type of loan in which the borrowers use the equity of their home as collateralThe loan amount is determined by the value of the property and the value of the property is determined by an appraiser from the lending institution. How can I get a home improvement loan with no equity. Some lenders will need to verify your employment when you apply for a mortgage line of credit lease or loan.

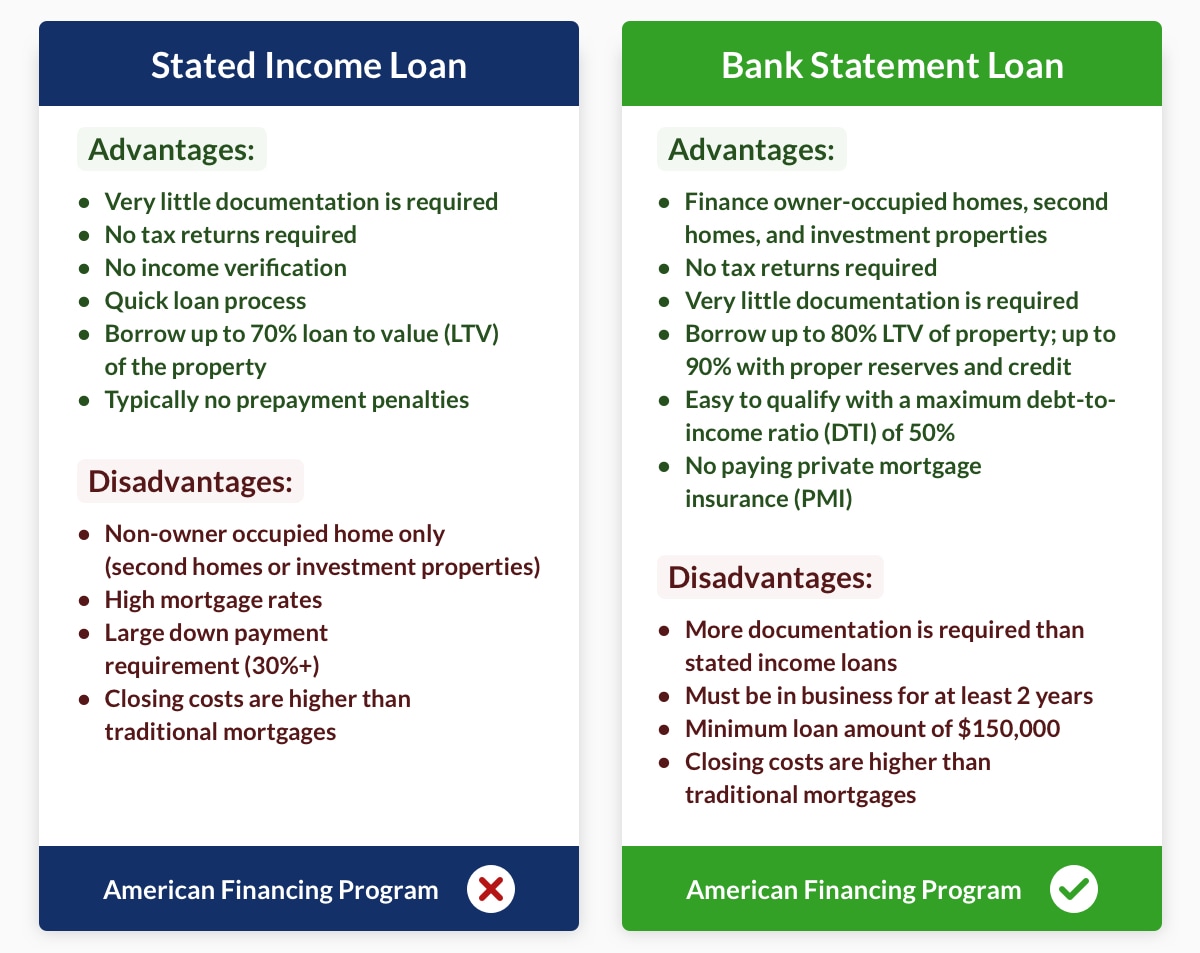

Variable-rate loans may not exceed 18 APR. Low-docno-doc loan programs are used for purchase loans fixed rate home equity loans and home equity credit lines HELOCs but no stated income for mortgages above 100. Prospective borrowers who have poor damaged or no credit typically find it.

The mortgage industry of the United States is a major financial sector. Guidelines will follow Spring EQs Home Equity Underwriting Guidelines. Citation neededHome equity loans are often used to finance major expenses such as home repairs medical bills or college.

Whether you are looking for a stated income loan in California New York or any of the other 48 states we can help. A verification of employment letter is a document provided by your employer that confirms your current employment status and income. With the written commitment we can process your lending option Processing may include.

All About Alternative Income Verification Loans Associates Home Loan

9 Personal Loans With No Income Verification Badcredit Org

Stated Income Loan Northstar Funding

Are No Income Verification Mortgages Still Available In 2022

Personal Loan With No Income Verification Bad Credit No Credit Check

No Income Verification Investor Loan Dscr Loan E Zip Mortgage

Stated Income Loans And More For Self Employed Borrowers

Understanding A No Income Home Equity Loan And If It Is Right For You Nicki Karen

No Income Check Mortgage Mortgagedepot

How To Get A Home Equity Loan With No Income Alpine Credits Ltd

Understanding A No Income Home Equity Loan And If It Is Right For You Nicki Karen

How To Get A Home Equity Loan With No Income Alpine Credits Ltd

What Are No Doc Loans How To Get A No Income Verification Mortgage

2022 Is Income Verification Needed For A Home Equity Loan Fha Co

Understanding A No Income Home Equity Loan And If It Is Right For You Nicki Karen

All About Alternative Income Verification Loans Associates Home Loan

No Doc Loans What They Are And How To Get One Credible

What You Need To Know About Home Equity Loans Credit Com

Guide To Personal Loans With No Income Verification Lantern By Sofi